Notice

Recent Posts

Recent Comments

Link

| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 |

Tags

- 변동성돌파전략

- 데이터분석

- GridSearchCV

- backtest

- 토익스피킹

- Crawling

- TimeSeries

- randomforest

- lstm

- Programmers

- 빅데이터분석기사

- Python

- 코딩테스트

- PolynomialFeatures

- Quant

- ADP

- SQL

- 파이썬 주식

- docker

- 볼린저밴드

- 실기

- 파트5

- 주식

- 백테스트

- 비트코인

- hackerrank

- 파이썬

- sarima

- 프로그래머스

- 데이터분석전문가

Archives

- Today

- Total

데이터 공부를 기록하는 공간

[파이썬 주식] 변동성돌파전략 - 7. kospi와 수익률 관계? 본문

### 1. 라이브러리 임포트

from pandas_datareader import data as pdr

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

import numpy as np

import time

from pykrx import stock

# matplotlib 한글 폰트 출력코드

import matplotlib

from matplotlib import font_manager, rc

import platform

try :

if platform.system() == 'Windows':

# 윈도우인 경우

font_name = font_manager.FontProperties(fname="c:/Windows/Fonts/malgun.ttf").get_name()

rc('font', family=font_name)

else:

# Mac 인 경우

rc('font', family='AppleGothic')

except :

pass

matplotlib.rcParams['axes.unicode_minus'] = False ### 2. 종목 데이터 불러오기

# 백테스트 함수 정의

def backtest(code, k, start):

code = str(code)+".KS"

df=pd.DataFrame()

df = pdr.get_data_yahoo(code, start)

df['변동폭'] = df['High']-df['Low']

df['목표가'] = df['Open'] + df['변동폭'].shift(1)*k

df['MA3_yes'] = df.Close.rolling(window=3).mean().shift(1)

df['내일시가'] = df.Open.shift(-1)

cond = ( df['High'] > df['목표가'] ) & ( df['목표가'] > df['MA3_yes'] )

df.loc[cond,'수익률'] = df.loc[cond,'내일시가']/df.loc[cond,'목표가']-0.0032

return df['수익률']

# 코드불러오기

codes = ['A204320', 'A028050', 'A035150', 'A011210', 'A131390', 'A006360', 'A005070', 'A005380', 'A001510', 'A001140', 'A068270', 'A004020', 'A032560', 'A200130', 'A039490',

'A079430', 'A000990', 'A011790', 'A210980', 'A002840', 'A035510', 'A029460', 'A086280', 'A005940', 'A006800', 'A020760', 'A011760', 'A069260']

codes = [ code[1:] for code in codes ]

# 수익률 함수 만들기

returns = pd.DataFrame()

for code in codes:

df = backtest(code,k=0.5,start='2020-01-01')

returns[code] = df

time.sleep(0.01)

returns.set_index(returns.index.strftime("%Y-%m-%d"),inplace=True)

# 수익률 결과 정리하기

returns_=pd.DataFrame()

returns_['min']= returns.min(axis=1)

returns_['mean']= returns.mean(axis=1)

returns_['median']= returns.median(axis=1)

returns_['max']= returns.max(axis=1)

returns_['count'] = returns.count(axis=1)

returns_['승패'] = returns_['mean'].map(lambda x:1 if x>1 else 0 )

### 3. 코스피 데이터 합치기

kospi = pdr.get_data_yahoo( "^KS11",'2020-01-01' )

kospi['어제종가']=kospi.Close.shift(1)

kospi['수익률']=(kospi['Close']/kospi['어제종가'])

kospi.set_index(kospi.index.strftime("%Y-%m-%d"),inplace=True)

# kospi수익률을 returns_함수에 합치기

returns_['코스피']=kospi['수익률']

returns_

### 4. 시각화

fig, ax = plt.subplots(figsize=(20,8))

returns_[['mean','코스피']].plot(ax=ax)

ax.plot(np.ones(returns_.shape[0]),color='black')

plt.figure(figsize=(20,10))

ax1 = plt.subplot(2,2,1)

cond = returns_['mean']>1

data= returns_.loc[cond]

data[['mean','코스피']].plot(ax=ax1)

ax1.plot(np.ones(data.shape[0]),color='black')

plt.title("mean>1")

ax2= plt.subplot(2,2,2)

cond = returns_['mean']<1

data= returns_.loc[cond]

data[['mean','코스피']].plot(ax=ax2)

ax2.plot(np.ones(data.shape[0]),color='black')

plt.title("mean<1")

ax3 = plt.subplot(2,2,3)

cond = returns_['코스피']>1

data= returns_.loc[cond]

data[['mean','코스피']].plot(ax=ax3)

ax3.plot(np.ones(data.shape[0]),color='black')

plt.title("코스피>1")

ax4= plt.subplot(2,2,4)

cond = returns_['코스피']<1

data= returns_.loc[cond]

data[['mean','코스피']].plot(ax=ax4)

ax4.plot(np.ones(data.shape[0]),color='black')

plt.title("코스피<1")

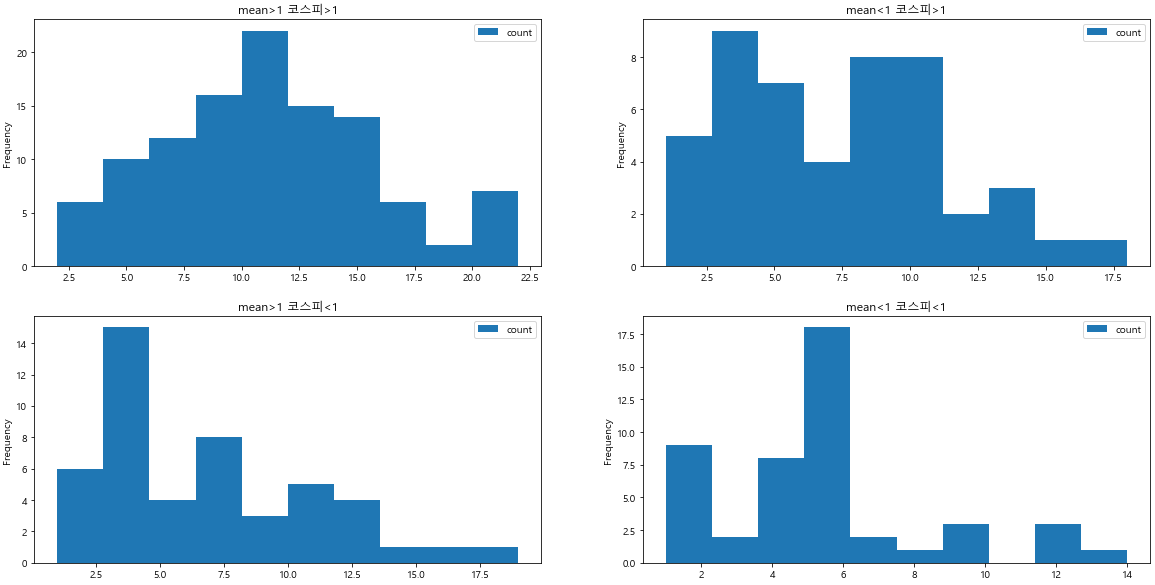

plt.figure(figsize=(20,10))

ax1 = plt.subplot(2,2,1)

cond = (returns_['mean']>1)&(returns_['코스피']>1)

data= returns_.loc[cond]

data[['count']].plot.hist(ax=ax1)

plt.title("mean>1 코스피>1")

ax2= plt.subplot(2,2,2)

cond = (returns_['mean']<1)&(returns_['코스피']>1)

data= returns_.loc[cond]

data[['count']].plot.hist(ax=ax2)

plt.title("mean<1 코스피>1")

ax3 = plt.subplot(2,2,3)

cond = (returns_['mean']>1)&(returns_['코스피']<1)

data= returns_.loc[cond]

data[['count']].plot.hist(ax=ax3)

plt.title("mean>1 코스피<1")

ax4= plt.subplot(2,2,4)

cond = (returns_['mean']<1)&(returns_['코스피']<1)

data= returns_.loc[cond]

data[['count']].plot.hist(ax=ax4)

plt.title("mean<1 코스피<1")

'STOCK > 변동성돌파전략' 카테고리의 다른 글

| [파이썬 주식] 변동성돌파전략 - 9. 조건추가 PB (0) | 2021.02.13 |

|---|---|

| [파이썬 주식] 변동성돌파전략 - 8. 실적 검토 (0) | 2021.02.06 |

| [파이썬 주식] 변동성돌파전략 - 6. 종목 개수와 수익률의 관계? (0) | 2021.01.26 |

| [파이썬 주식] 변동성돌파전략 - 5.백테스트 결과 시각화 해보기 (0) | 2021.01.25 |

| [파이썬 주식] 변동성돌파전략 - 4. 적정 k값은? (0) | 2021.01.24 |

Comments