Notice

Recent Posts

Recent Comments

Link

| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 |

Tags

- docker

- 파이썬

- hackerrank

- Python

- 토익스피킹

- randomforest

- 실기

- backtest

- Crawling

- Programmers

- 볼린저밴드

- 코딩테스트

- PolynomialFeatures

- 파트5

- lstm

- 주식

- 프로그래머스

- Quant

- 백테스트

- 데이터분석전문가

- SQL

- 변동성돌파전략

- 비트코인

- ADP

- 데이터분석

- 파이썬 주식

- GridSearchCV

- sarima

- TimeSeries

- 빅데이터분석기사

Archives

- Today

- Total

데이터 공부를 기록하는 공간

plotly 캔들스틱, 저항선 그리기 본문

"""데이터 불러오기 """

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import pyupbit

df = pyupbit.get_ohlcv("KRW-DOGE", interval = "minute5", count=12*24*7*4)■ plotly로 그리기

#import the libraries

import plotly.subplots as ms

import plotly.graph_objects as go

data = df.reset_index().rename(columns={'index':'datetime'}).copy()

data = data[['datetime','open','high','low','close','volume','value']]

#Make Subplot of 2 rows to plot 2 graphs sharing the x axis

fig = ms.make_subplots(rows=2, cols=1,

shared_xaxes=True, vertical_spacing=0.02)

#Add Candlstick Chart to Row 1 of subplot

fig.add_trace(go.Candlestick(x = data['datetime'],

open = data['open'],

high = data['high'],

low = data['low'],

close = data['close'],

increasing_line_color = 'green',

decreasing_line_color = 'red'),

row=1,

col=1)

#Add Volume Chart to Row 2 of subplot

fig.add_trace(go.Bar(x=data['datetime'],

y=data['volume']),

row=2,

col=1)

#Update Price Figure layout

fig.update_layout(title = 'Interactive CandleStick & Volume Chart',

yaxis1_title = 'ETS Price ($)',

yaxis2_title = 'Volume (M)',

xaxis2_title = 'Time',

xaxis1_rangeslider_visible = False,

xaxis2_rangeslider_visible = False,

autosize=False,

width=1200,

height=600)

(참고로 jupyter notebook에서는 보이지만, jupyter lab에서는 안보임, 이유는 모르겠음)

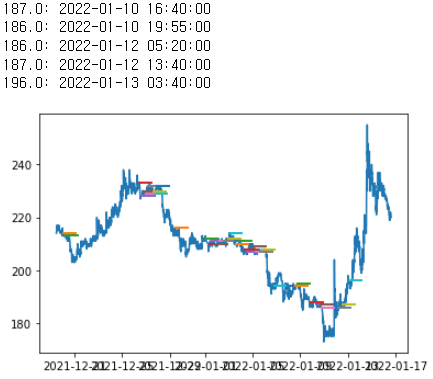

■ 저항선 그리기

import datetime

fig, ax = plt.subplots()

ax.plot(df.index, df.high, label='high')

pivots = []

dates = []

counter = 0

lastPivot=0

Range = [0,0,0,0,0,0,0,0,0,0]

dateRange = [0,0,0,0,0,0,0,0,0,0]

for i in df.index:

currentMax = max(Range, default=0)

value = df['high'][i]

Range = Range[1:9]

Range.append(value)

dateRange = dateRange[1:9]

dateRange.append(i)

if currentMax == max(Range, default=0):

counter += 1

else:

counter = 0

if counter == 30:

lastPivot = currentMax

dateloc = Range.index(lastPivot)

lastDate = dateRange[dateloc]

pivots.append(lastPivot)

dates.append(lastDate)

#print(str(pivots))

#print(str(dates))

timeD = datetime.timedelta(days=1)

for index in range(len(pivots)):

print(str(pivots[index])+": " +str(dates[index]))

ax.plot_date([dates[index], dates[index]+timeD],

[pivots[index], pivots[index]],

linestyle="-", linewidth=2, marker=",")

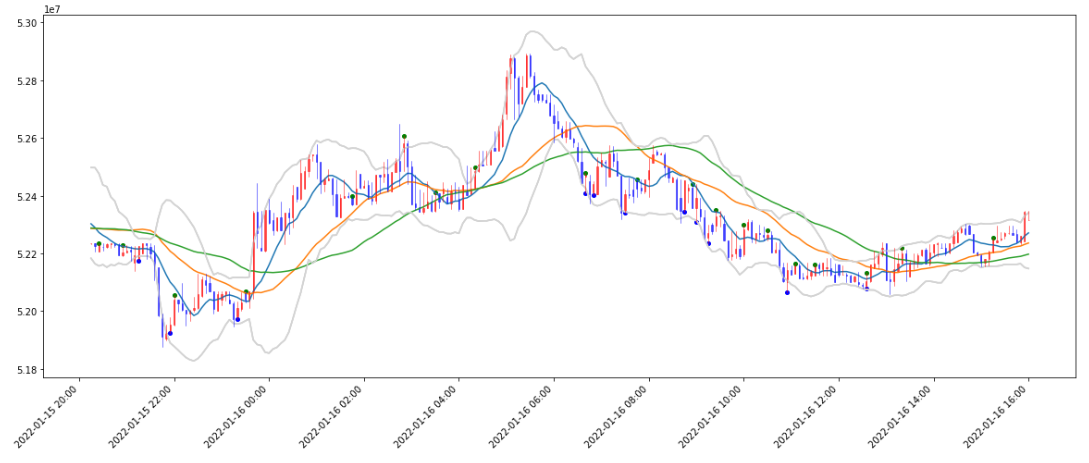

■ candle stick

df = pyupbit.get_ohlcv("KRW-BTC", interval = "minute5", count=12*24)from mpl_finance import candlestick_ohlc

import matplotlib.dates as mdates

import matplotlib.ticker as mticker

data = df.copy()

fig, ax = plt.subplots(figsize=(20,8))

# calculate Bollinger Bands

smasUsed = [10,30,50]

for sma in smasUsed:

data['SMA_'+str(sma)] = data.loc[:,'close'].rolling(window=sma).mean()

window_b = 15 #choose moving average

stdev = 2

data['SMA'+str(window_b)] = data['close'].rolling(window=window_b).mean()

data['stddev'] = data['close'].rolling(window=window_b).std()

data['upper'] = data['SMA'+str(window_b)] + data['stddev']*stdev

data['lower'] = data['SMA'+str(window_b)] - data['stddev']*stdev

data['Date'] = mdates.date2num(data.index)

# Calculate Stochastic

window_p = 10

K =4

D =4

data['RolHigh'] = data['high'].rolling(window=window_p).max()

data['RolLow'] = data['low'].rolling(window=window_p).min()

data['stok'] = ((data['close'] - data['RolLow'])/

(data['RolHigh']-data['RolLow']))*100

data['K'] = data['stok'].rolling(window=K).mean()

data['D'] = data['K'].rolling(window=D).mean()

data['GD'] = data['high'] #create GD column to store green dots

ohlc = []

data = data.iloc[max(smasUsed):]

greenDotDate = [] # store dates of green dots

greenDot = [] # store values of green dots

lastK = 0 # store yesterday's fast stoch

lastD = 0 # store yesterday's slow stock

lastLow = 0 # stord yesterdays lower

lastClose =0 # stord yesterdays close

lastLowBB = 0 #stord yesterdays lower bband

for i in data.index:

append_me = data['Date'][i], data['open'][i], data['high'][i], data['low'][i], data['close'][i], data['volume'][i]

ohlc.append(append_me)

if data['K'][i] > data['D'][i] and lastK < lastD and lastK< 60:

plt.plot(data['Date'][i], data['high'][i]+1, marker='o', ms=4, ls="", color='g')

greenDotDate.append(i)

greenDot.append(data['high'][i])

if ((lastLow<lastLowBB) or (data['low'][i] < data['lower'][i])) and (data['close'][i]>lastClose and data['close'][i]>data['lower'][i]) and lastK < 60 :

plt.plot(data['Date'][i], data['low'][i]-1, marker='o', ms=4, ls="", color='b')

lastK = data['K'][i]

lastD = data['D'][i]

lastLow = data['low'][i]

lastClose = data['close'][i]

lastLowBB = data['lower'][i]

for sma in smasUsed:

data['SMA_'+str(sma)].plot(label='close')

data['upper'].plot(label='close',color='lightgray')

data['lower'].plot(label='close',color='lightgray')

candlestick_ohlc(ax, ohlc, width=.001, colorup='r', colordown='b', alpha=0.5) #width로 사이즈 조절해야함

ax.xaxis.set_major_formatter(mdates.DateFormatter("%Y-%m-%d %H:%M"))

#ax.xaxis.set_major_locator(mticker.MaxNLocater(8))

plt.tick_params(axis='x', rotation=45)

■ candle stick + 저항선

from mpl_finance import candlestick_ohlc

import matplotlib.dates as mdates

import matplotlib.ticker as mticker

data = df.copy()

fig, ax = plt.subplots(figsize=(20,8))

# calculate Bollinger Bands

smasUsed = [10,30,50]

for sma in smasUsed:

data['SMA_'+str(sma)] = data.loc[:,'close'].rolling(window=sma).mean()

window_b = 15 #choose moving average

stdev = 2

data['SMA'+str(window_b)] = data['close'].rolling(window=window_b).mean()

data['stddev'] = data['close'].rolling(window=window_b).std()

data['upper'] = data['SMA'+str(window_b)] + data['stddev']*stdev

data['lower'] = data['SMA'+str(window_b)] - data['stddev']*stdev

data['Date'] = mdates.date2num(data.index)

# Calculate Stochastic

window_p = 10

K =4

D =4

data['RolHigh'] = data['high'].rolling(window=window_p).max()

data['RolLow'] = data['low'].rolling(window=window_p).min()

data['stok'] = ((data['close'] - data['RolLow'])/

(data['RolHigh']-data['RolLow']))*100

data['K'] = data['stok'].rolling(window=K).mean()

data['D'] = data['K'].rolling(window=D).mean()

data['GD'] = data['high'] #create GD column to store green dots

ohlc = []

data = data.iloc[max(smasUsed):]

greenDotDate = [] # store dates of green dots

greenDot = [] # store values of green dots

lastK = 0 # store yesterday's fast stoch

lastD = 0 # store yesterday's slow stock

lastLow = 0 # stord yesterdays lower

lastClose =0 # stord yesterdays close

lastLowBB = 0 #stord yesterdays lower bband

for i in data.index:

append_me = data['Date'][i], data['open'][i], data['high'][i], data['low'][i], data['close'][i], data['volume'][i]

ohlc.append(append_me)

if data['K'][i] > data['D'][i] and lastK < lastD and lastK< 60:

plt.plot(data['Date'][i], data['high'][i]+1, marker='o', ms=4, ls="", color='g')

greenDotDate.append(i)

greenDot.append(data['high'][i])

if ((lastLow<lastLowBB) or (data['low'][i] < data['lower'][i])) and (data['close'][i]>lastClose and data['close'][i]>data['lower'][i]) and lastK < 60 :

plt.plot(data['Date'][i], data['low'][i]-1, marker='o', ms=4, ls="", color='b')

lastK = data['K'][i]

lastD = data['D'][i]

lastLow = data['low'][i]

lastClose = data['close'][i]

lastLowBB = data['lower'][i]

for sma in smasUsed:

data['SMA_'+str(sma)].plot(label='close')

data['upper'].plot(label='close',color='lightgray')

data['lower'].plot(label='close',color='lightgray')

candlestick_ohlc(ax, ohlc, width=.002, colorup='r', colordown='orange', alpha=0.5) #width로 사이즈 조절해야함

ax.xaxis.set_major_formatter(mdates.DateFormatter("%Y-%m-%d %H:%M"))

#ax.xaxis.set_major_locator(mticker.MaxNLocater(8))

plt.tick_params(axis='x', rotation=45)

pivots = []

dates = []

counter = 0

lastPivot=0

Range = [0,0,0,0,0,0,0,0,0,0]

dateRange = [0,0,0,0,0,0,0,0,0,0]

for i in data.index:

currentMax = max(Range, default=0)

value = data['high'][i]

Range = Range[1:9]

Range.append(value)

dateRange = dateRange[1:9]

dateRange.append(i)

if currentMax == max(Range, default=0):

counter += 1

else:

counter = 0

if counter == 6:

lastPivot = currentMax

dateloc = Range.index(lastPivot)

lastDate = dateRange[dateloc]

pivots.append(lastPivot)

dates.append(lastDate)

#print(str(pivots))

#print(str(dates))

timeD = datetime.timedelta(days=1.5/24)

for index in range(len(pivots)):

print(str(pivots[index])+": " +str(dates[index]))

ax.plot_date([dates[index], dates[index]+timeD],

[pivots[index], pivots[index]],

linestyle="-", linewidth=2, marker=",")

ax.annotate(str(int(pivots[index])), (mdates.date2num(dates[index]), pivots[index]), xytext=(-10,7),

textcoords='offset points', fontsize=12, arrowprops=dict(arrowstyle='-|>'))

ax.set_xlabel('Date')

ax.set_ylabel('Price')

ax.set_title("BTC 5minutes")

ax.set_ylim(data['low'].min()*0.9995, data['high'].max()*1.0015)

(참고)

https://www.youtube.com/watch?v=ePkRMVRh_sg&list=PLPfme2mwsQ1FQhH1icKEfiYdLSUHE-Wo5&index=7

'STOCK > 비트코인' 카테고리의 다른 글

| 50% 리밸런싱 (0) | 2022.02.05 |

|---|---|

| 1% GAP (0) | 2022.01.17 |

| 볼린저밴드-찾기 (0) | 2022.01.16 |

| 볼린저밴드-추세추종-문제점 (0) | 2022.01.16 |

| 볼린저밴드-추세추종-return 계산하기(백테스트 문제점) (0) | 2022.01.11 |

Comments