STOCK/비트코인

백테스트 - SMA 1시간봉

BOTTLE6

2022. 1. 3. 23:00

data = df.copy()

data = data[['close']]

data['SMA1'] = data['close'].rolling(42).mean()

data['SMA2'] = data['close'].rolling(180).mean()

data.plot(title="2years BTC", figsize=(10,4))import numpy as np

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

import pyupbit

df = pyupbit.get_ohlcv("KRW-BTC","hour1", count=24*30*24)

data['position'] = np.where(data['SMA1']>data['SMA2'],1,0)

data.dropna(inplace=True)

data['position'].plot(ylim=[-1.1, 1.1], title='market positioning', figsize=(10,4))

;

# 로그수익률

data['strategy'] = data['position'].shift(1)*data['returns']

data[['returns','strategy']].sum()

data[['returns','strategy']].sum().apply(np.exp)

data[['returns','strategy']].cumsum().apply(np.exp).plot(figsize=(10,4));

매도조건 변경 : SMA1 > SMA2 & CLOSE < SMA1

data = df.copy()

data = data[['close']]

data['SMA1'] = data['close'].rolling(42).mean()

data['SMA2'] = data['close'].rolling(180).mean()

data.dropna(inplace=True)

#cond = data['SMA1']>data['SMA2']

#data.loc[cond, 'position'] = 1

data['position'] = np.where(data['SMA1']>data['SMA2'],1,np.NaN)

data['position'].plot(ylim=[-0.1, 1.1], title='market positioning', figsize=(10,4))

;

cond = ( data['position']==1 ) & ( data['close'] < data['SMA1'])

data.loc[cond,'position'] = 0

data['position'].plot(ylim=[-0.1, 1.1], title='market positioning', figsize=(10,4))

;

data['position'] = data['position'].fillna(method='ffill')

data['position'].plot(ylim=[-0.1, 1.1], title='market positioning', figsize=(10,4))

;

data['returns'] = np.log(data['close']/data['close'].shift(1))

data['strategy'] = data['position'].shift(1)*data['returns']

data[['returns','strategy']].sum()

data[['returns','strategy']].sum().apply(np.exp)

data[['returns','strategy']].cumsum().apply(np.exp).plot(figsize=(10,4));

▶ 매도조건을 바꾸니 조금 더 수익률이 MDD가 낮아지는 것 같다. but....

data['cumret'] = data['strategy'].cumsum().apply(np.exp)

data['cummax'] = data['cumret'].cummax()

data[['cumret','cummax']].dropna().plot(figsize=(10,4));

# strategy의 MDD

drawdown = data['cummax'] - data['cumret']

drawdown.max()

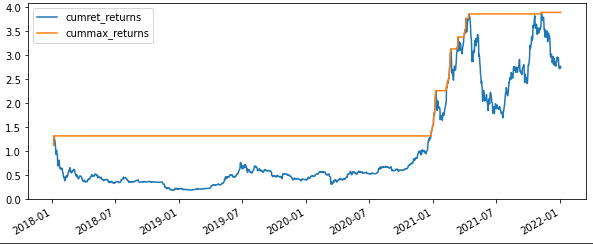

data['cumret_returns'] = data['returns'].cumsum().apply(np.exp)

data['cummax_returns'] = data['cumret_returns'].cummax()

data[['cumret_returns','cummax_returns']].dropna().plot(figsize=(10,4));

# 보유 시 MDD

drawdown = data['cummax_returns'] - data['cumret_returns']

drawdown.max()

보유시 MDD 217% 보다 전략 MDD 109%가 작게 느껴지지만...........