STOCK/비트코인

백테스트 - MLP 5분봉 volume 변수추가

BOTTLE6

2022. 1. 3. 01:46

df = pd.read_csv("20220103_btc_minute5_90days.csv").rename(columns = {"Unnamed: 0":'datetime'}).set_index("datetime")

df = df[['close','volume']]

data = df.copy()

data['return'] = np.log(data['close']/data['close'].shift(1))

data['volumeR'] = np.log(data['volume']/data['volume'].shift(1))

data.dropna(inplace=True)

data['direction'] = np.where(data['return']>0, 1, 0)

lags = 3

cols = []

for lag in range(1, lags+1):

col = "return_{}".format(lag)

data[col] = data['return'].shift(lag)

cols.append(col)

for lag in range(1, lags+1):

col = "volumeR_{}".format(lag)

data[col] = data['volumeR'].shift(lag)

cols.append(col)

data.dropna(inplace=True)

data

data['momentum'] = data['return'].rolling(5).mean().shift(1)

data['volatility'] = data['return'].rolling(20).std().shift(1)

data['distance'] = (data['close']-data['close'].rolling(50).mean()).shift(1)

data.dropna(inplace=True)

cols.extend(['momentum','volatility','distance'])cutoff = '2021-12-07'

training_data = data[data.index<cutoff].copy()

mu, std = training_data.mean(), training_data.std()

training_data_ = (training_data-mu)/std

test_data = data[data.index>=cutoff].copy()

test_data_ = (test_data-mu)/stdimport tensorflow as tf

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import Dropout

from keras.optimizers import Adam, RMSprop

from keras.metrics import Precision

optimizer = Adam(learning_rate=0.0001)

def set_seeds(seed=100):

#random.seed(seed)

np.random.seed(seed)

tf.random.set_seed(100)

set_seeds()

model = Sequential()

model.add(Dense(128, activation='relu',

input_shape=(len(cols),)))

model.add(Dropout(0.3))

model.add(Dense(128, activation='relu'))

model.add(Dropout(0.3))

model.add(Dense(64, activation='relu'))

model.add(Dense(1, activation='sigmoid'))

model.compile(optimizer=optimizer,

loss='binary_crossentropy',

metrics=['Precision'])%%time

model.fit(training_data_[cols], training_data['direction'],

epochs=20, verbose=False,

validation_split=0.2, shuffle=False)

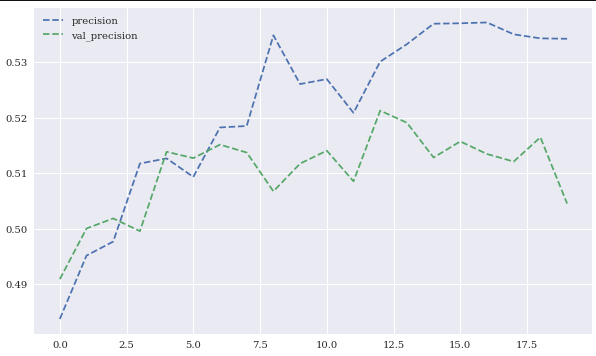

res = pd.DataFrame(model.history.history)

res[['precision','val_precision']].plot(figsize=(10,6), style='--')

cutoff_value = 0.5

pred = np.where(model.predict(training_data_[cols])>cutoff_value, 1,0)

training_data['prediction'] = np.where(pred > 0, 1, 0)

training_data['strategy'] = (training_data['prediction']*

training_data['return']*0.9995)

training_data[['return','strategy']].sum().apply(np.exp)

training_data[['return','strategy']].cumsum().apply(np.exp).plot(figsize=(10,6))

cutoff_value = 0.6

pred = np.where(model.predict(test_data_[cols])>cutoff_value, 1,0)

test_data['prediction'] = np.where(pred > 0, 1, 0)

test_data['strategy'] = (test_data['prediction']*

test_data['return']*0.9995)

test_data[['return','strategy']].sum().apply(np.exp)

test_data[['return','strategy']].cumsum().apply(np.exp).plot(figsize=(10,6))

▶

volume의 lag데이터를 포함시켜도 소용이 없었다.

테스트 데이터를 하락폭이 큰 데이터를 제외시켜도 소용이 없었다.

cutoff_value를 높게 변경시켜서 거래를 줄여보아도 소용이 없었다.

fbprophet을 활용해야할까? ask, bid데이터를 추가하면 조금 달라질까?